Search

Search for projects by name

Hyperliquid

Hyperliquid

L2BEAT Bridges is a work in progress. You might find incomplete research or inconsistent naming. Join our Discord to suggest improvements!

About

Hyperliquid is a performant exchange with its bridge on Arbitrum. It uses a custom consensus algorithm called HyperBFT.

About

Hyperliquid is a performant exchange with its bridge on Arbitrum. It uses a custom consensus algorithm called HyperBFT.

Principle of operation

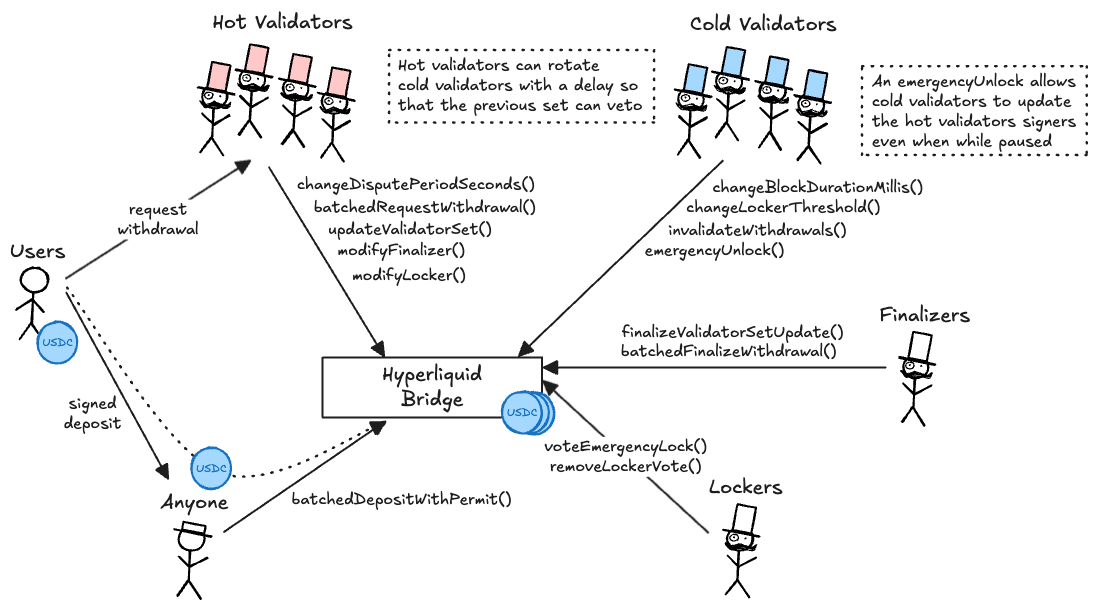

Hyperliquid is a DEX with its main bridge implemented as a smart contract on Arbitrum. Deposits in USDC can be locked in the bridge escrow and are picked up by the permissioned node to be used on the platform. Withdrawals are handled by external actors (validators and finalizers). Although the platform with its main bridge on Arbitrum suggests a decentralized appchain setup, there is no proof system or data availability solution that would qualify it as such.

Transfers are externally verified

Hyperliquid is composed of two sets of permissioned validators, one being a “hot” validator set, and the other being a “cold” one. The hot validator set is responsible for initiating withdrawals upon user requests, while cold validators can invalidate them during the 200s challenge period and/or rotate both validator sets after an emergency pause. Both sets are currently composed of 4 validators with equal power. The system accepts a request if signed by 2/3+1 of validators power.

Funds can be stolen if the permissioned validator majority sign an invalid withdrawal request.

Funds can be frozen if the permissioned validator set stops processing withdrawals.

Funds can be frozen if the permissioned lockers maliciously pause the bridge.

Funds can be stolen if the permissioned finalizers don't finalize withdrawals.

Arbitrum One

Single contract containing the logic for the Hyperliquid bridge. It manages deposits, withdrawals, the hot and cold validator sets, as well as the lockers, finalizers, and all the permissioned functions. The current locker threshold is 2 and the minimum validator threshold is 2/3*4.

- Roles:

- coldAddresses: EOA 3, EOA 4, EOA 5, EOA 7

- finalizers: EOA 1, EOA 2, EOA 6, EOA 8, EOA 9

- hotAddresses: EOA 1, EOA 2, EOA 6, EOA 8

- lockers: EOA 1, EOA 2, EOA 6, EOA 8, EOA 9

- This contract stores the following tokens: USDC.

Value Secured is calculated based on these smart contracts and tokens:

Hyperliquid bridge escrow on Arbitrum.