Search

Search for projects by name

Parallel

Parallel

Parallel is deprecating their Orbit stack Layer 2.

Critical contracts can be upgraded by an EOA which could result in the loss of all funds.

Badges

About

Parallel is an Ethereum L2 solution utilizing Arbitrum Nitro technology.

Badges

About

Parallel is an Ethereum L2 solution utilizing Arbitrum Nitro technology.

Why is the project listed in others?

Consequence: projects without a proper proof system fully rely on single entities to safely update the state. A malicious proposer can finalize an invalid state, which can cause loss of funds.

Learn more about the recategorisation here.

2024 Jan 01 — 2025 Aug 02

The section shows the operating costs that L2s pay to Ethereum.

2024 Jan 01 — 2025 Aug 02

ArbOS v20 upgrade

2024 Apr 10th

Introduces EIP-4844 data blobs for L1 data availability and Dencun-related opcodes on L2.

Funds can be stolen if

MEV can be extracted if

No actor outside of the single Proposer can submit fraud proofs. Interactive proofs (INT) require multiple transactions over time to resolve. The challenge protocol can be subject to delay attacks. There is a 6d challenge period.

All of the data needed for proof construction is published on Ethereum L1.

There is no window for users to exit in case of an unwanted regular upgrade since contracts are instantly upgradable.

Anyone can become a Proposer after 12d 8h of inactivity from the currently whitelisted Proposers.

All transaction data is recorded on chain

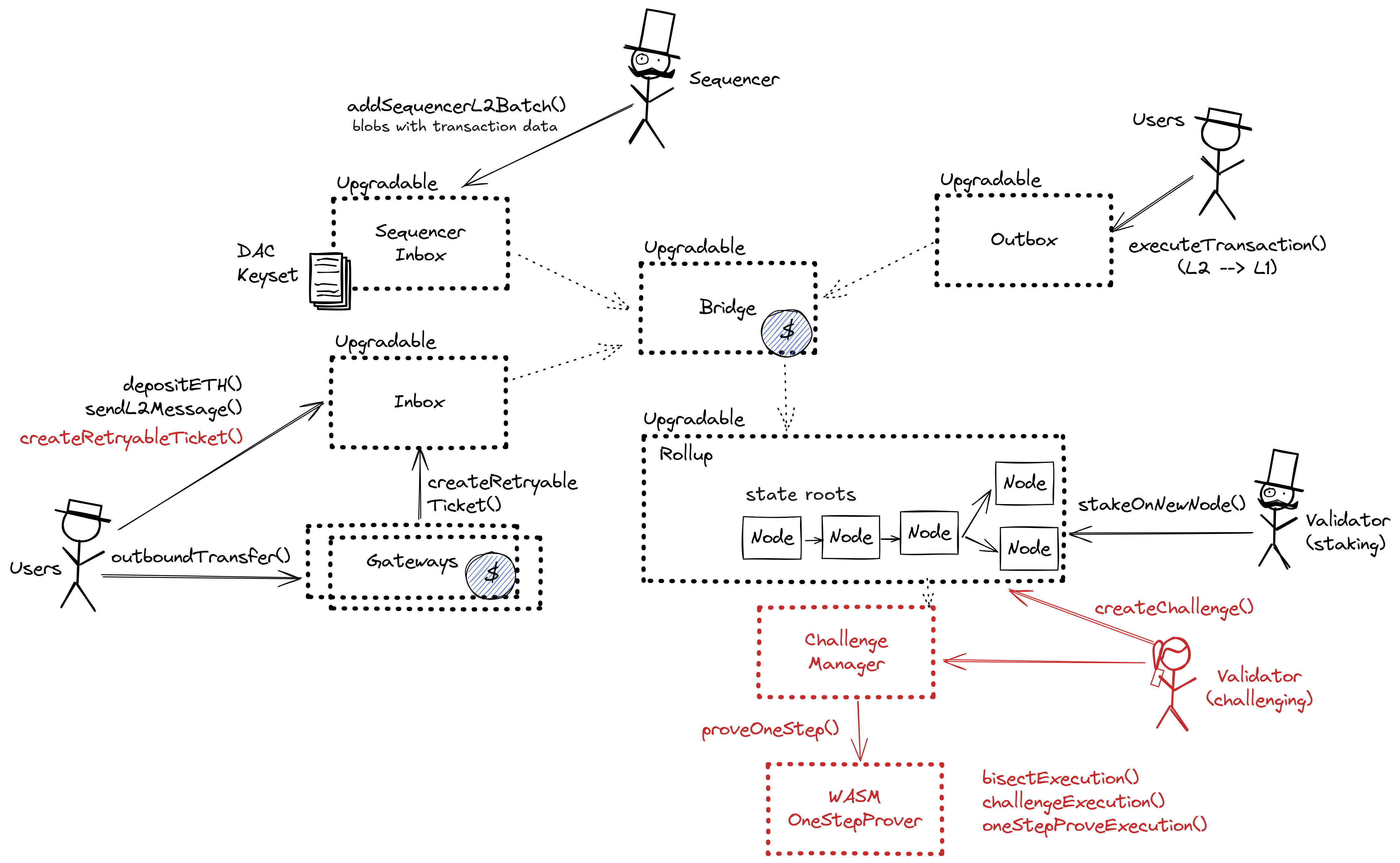

All executed transactions are submitted to an on chain smart contract. The execution of the rollup is based entirely on the submitted transactions, so anyone monitoring the contract can know the correct state of the rollup chain.

- Sequencing followed by deterministic execution - Arbitrum documentation

- SequencerInbox.sol - source code, addSequencerL2BatchFromOrigin function

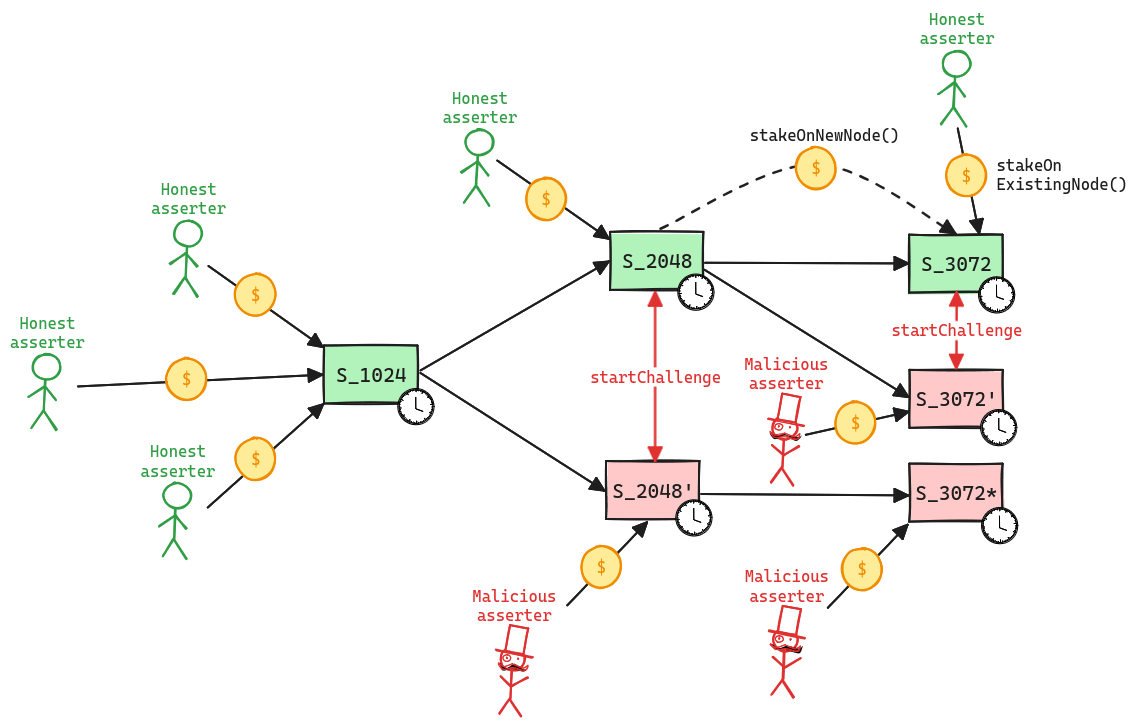

Updates to the system state can be proposed and challenged by a set of whitelisted validators. If a state root passes the challenge period, it is optimistically considered correct and made actionable for withdrawals.

Whitelisted validators propose state roots as children of a previous state root. A state root can have multiple conflicting children. This structure forms a graph, and therefore, in the contracts, state roots are referred to as nodes. Each proposal requires a stake, currently set to 0.1 ETH, that can be slashed if the proposal is proven incorrect via a fraud proof. Stakes can be moved from one node to one of its children, either by calling stakeOnExistingNode or stakeOnNewNode. New nodes cannot be created faster than the minimum assertion period by the same validator, currently set to 15m. The oldest unconfirmed node can be confirmed if the challenge period has passed and there are no siblings, and rejected if the parent is not a confirmed node or if the challenge period has passed and no one is staked on it.

Funds can be stolen if none of the whitelisted verifiers checks the published state. Fraud proofs assume at least one honest and able validator (CRITICAL).

A challenge can be started between two siblings, i.e. two different state roots that share the same parent, by calling the startChallenge function. Validators cannot be in more than one challenge at the same time, meaning that the protocol operates with partial concurrency. Since each challenge lasts 6d, this implies that the protocol can be subject to delay attacks, where a malicious actor can delay withdrawals as long as they are willing to pay the cost of losing their stakes. If the protocol is delayed attacked, the new stake requirement increases exponentially for each challenge period of delay. Challenges are played via a bisection game, where asserter and challenger play together to find the first instruction of disagreement. Such instruction is then executed onchain in the WASM OneStepProver contract to determine the winner, who then gets half of the stake of the loser. As said before, a state root is rejected only when no one left is staked on it. The protocol does not enforces valid bisections, meaning that actors can propose correct initial claim and then provide incorrect midpoints.

The system has a centralized sequencer

While forcing transaction is open to anyone the system employs a privileged sequencer that has priority for submitting transaction batches and ordering transactions.

MEV can be extracted if the operator exploits their centralized position and frontruns user transactions.

Users can force any transaction

Because the state of the system is based on transactions submitted on the underlying host chain and anyone can submit their transactions there it allows the users to circumvent censorship by interacting with the smart contract on the host chain directly. After a delay of 2d in which a Sequencer has failed to include a transaction that was directly posted to the smart contract, it can be forcefully included by anyone on the host chain, which finalizes its ordering.

Delayed forced transactions

To force transactions from the host chain, users must first enqueue “delayed” messages in the “delayed” inbox of the Bridge contract. Only authorized Inboxes are allowed to enqueue delayed messages, and the so-called Inbox contract is the one used as the entry point by calling the sendMessage or sendMessageFromOrigin functions. If the centralized sequencer doesn’t process the request within some time bound, users can call the forceInclusion function on the SequencerInbox contract to include the message in the canonical chain. The time bound is hardcoded to be 2d.

Regular messaging

Autonomous exit

Users can (eventually) exit the system by pushing the transaction on L1 and providing the corresponding state root. The only way to prevent such withdrawal is via an upgrade.

EVM compatible smart contracts are supported

Arbitrum One uses Nitro technology that allows running fraud proofs by executing EVM code on top of WASM.

Ethereum

Roles:

Can submit transaction batches or commitments to the SequencerInbox contract on the host chain.

Can propose new state roots (called nodes) and challenge state roots on the host chain.

Actors:

A Multisig with 3/3 threshold.

- Can upgrade with no delay

- Inbox UpgradeExecutor → ProxyAdmin

- L1WethGateway UpgradeExecutor → ProxyAdmin

- ChallengeManager UpgradeExecutor → ProxyAdmin

- RollupEventInbox UpgradeExecutor → ProxyAdmin

- Bridge UpgradeExecutor → ProxyAdmin

- GatewayRouter UpgradeExecutor → ProxyAdmin

- RollupProxy UpgradeExecutor

- ERC20Gateway UpgradeExecutor → ProxyAdmin

- CustomGateway UpgradeExecutor → ProxyAdmin

- SequencerInbox UpgradeExecutor → ProxyAdmin

- Outbox UpgradeExecutor → ProxyAdmin

- UpgradeExecutor UpgradeExecutor → ProxyAdmin

- Can interact with RollupProxy

- Pause and unpause and set important roles and parameters in the system contracts: Can delegate Sequencer management to a BatchPosterManager address, manage data availability and DACs, set the Sequencer-only window, introduce an allowList to the bridge and whitelist Inboxes/Outboxes UpgradeExecutor

- Can upgrade with no delay

- Inbox UpgradeExecutor → ProxyAdmin

- L1WethGateway UpgradeExecutor → ProxyAdmin

- ChallengeManager UpgradeExecutor → ProxyAdmin

- RollupEventInbox UpgradeExecutor → ProxyAdmin

- Bridge UpgradeExecutor → ProxyAdmin

- GatewayRouter UpgradeExecutor → ProxyAdmin

- RollupProxy UpgradeExecutor

- ERC20Gateway UpgradeExecutor → ProxyAdmin

- CustomGateway UpgradeExecutor → ProxyAdmin

- SequencerInbox UpgradeExecutor → ProxyAdmin

- Outbox UpgradeExecutor → ProxyAdmin

- UpgradeExecutor UpgradeExecutor → ProxyAdmin

- Can interact with RollupProxy

- Pause and unpause and set important roles and parameters in the system contracts: Can delegate Sequencer management to a BatchPosterManager address, manage data availability and DACs, set the Sequencer-only window, introduce an allowList to the bridge and whitelist Inboxes/Outboxes UpgradeExecutor

Ethereum

Contract that allows challenging state roots. Can be called through the RollupProxy by Validators or the UpgradeExecutor.

- Roles:

- admin: ProxyAdmin; ultimately EOA 1, ParallelMultisig

Escrow contract for the project’s gas token (can be different from ETH). Keeps a list of allowed Inboxes and Outboxes for canonical bridge messaging.

- Roles:

- admin: ProxyAdmin; ultimately EOA 1, ParallelMultisig

- This contract stores the following tokens: ETH.

Central contract for the project’s configuration like its execution logic hash (wasmModuleRoot) and addresses of the other system contracts. Entry point for Proposers creating new Rollup Nodes (state commitments) and Challengers submitting fraud proofs (In the Orbit stack, these two roles are both held by the Validators).

- Roles:

- admin: UpgradeExecutor; ultimately EOA 1, ParallelMultisig

- owner: UpgradeExecutor; ultimately EOA 1, ParallelMultisig

- validators: EOA 2

A sequencer (registered in this contract) can submit transaction batches or commitments here.

- Roles:

- admin: ProxyAdmin; ultimately EOA 1, ParallelMultisig

- batchPosters: EOA 3, EOA 4

Central contract defining the access control permissions for upgrading the system contract implementations.

- Roles:

- admin: ProxyAdmin; ultimately EOA 1, ParallelMultisig

- executors: EOA 1, ParallelMultisig

Escrows deposited ERC-20 assets for the canonical Bridge. Upon depositing, a generic token representation will be minted at the destination. Withdrawals are initiated by the Outbox contract.

- Roles:

- admin: ProxyAdmin; ultimately EOA 1, ParallelMultisig

- This contract can store any token.

This routing contract maps tokens to the correct escrow (gateway) to be then bridged with canonical messaging.

- Roles:

- admin: ProxyAdmin; ultimately EOA 1, ParallelMultisig

Escrows deposited assets for the canonical bridge that are externally governed or need custom token contracts with e.g. minting rights or upgradeability.

- Roles:

- admin: ProxyAdmin; ultimately EOA 1, ParallelMultisig

- This contract can store any token.

- Roles:

- admin: ProxyAdmin; ultimately EOA 1, ParallelMultisig

One of the modular contracts used for the last step of a fraud proof, which is simulated inside a WASM virtual machine.

This contract implements view only utilities for validators.

Helper contract sending configuration data over the bridge during the systems initialization.

- Roles:

- admin: ProxyAdmin; ultimately EOA 1, ParallelMultisig

One of the modular contracts used for the last step of a fraud proof, which is simulated inside a WASM virtual machine.

- Roles:

- owner: UpgradeExecutor

One of the modular contracts used for the last step of a fraud proof, which is simulated inside a WASM virtual machine.

One of the modular contracts used for the last step of a fraud proof, which is simulated inside a WASM virtual machine.

One of the modular contracts used for the last step of a fraud proof, which is simulated inside a WASM virtual machine.

Value Secured is calculated based on these smart contracts and tokens:

Main entry point for users depositing ERC20 tokens. Upon depositing, on L2 a generic, “wrapped” token will be minted.

Main entry point for users depositing ERC20 tokens that require minting custom token on L2.

Contract managing Inboxes and Outboxes. It escrows ETH sent to L2.

The current deployment carries some associated risks:

Funds can be stolen if a contract receives a malicious code upgrade. There is no delay on code upgrades (CRITICAL).